I just need to know what politician would say he needs to break all the laws, steal the mail bags with votes and force his ways and self into our lives, abuse us with COVID and....?

Let's focus on the offer and the acceptance for a moment. You understand the concept in any situation generally. But, some situations require a further line of explanation due to the arguments that transpire when someone runs out of stock and there is a note on the fine print at the cashier counter that says all prices are subject to change and are subject to product availability or it says "while quantities last" or "best offer". We would call this scenario not an offer but an invitation by the seller to consider offers or to treat offers; an invitation to treat.

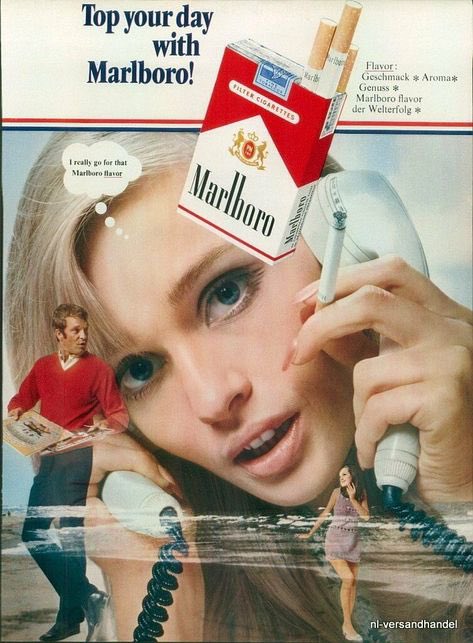

A "While quantities last" item could involve a whole box of Marlboro cigarettes imported from Germany or a shelf of bananas on sale for .30 pence/ pound or 10¢/lb. It could be an airline seat in economy but it is only available until sold out where the airline confirms the ticket price is "subject to availability" or while quantities last. If they run out, they do not want to be sued for loss of bargain or a failure by the offeror to complete the deal, accept the money and provide the goods requested.

When you see such terminology in the advertising such as "best offer", "prices subject to change" or "while quantities last" or any items on sale in a retail environment, you consider this advertising an "invitation to treat offers" and the offeror says he agrees to accept the suggested listed price that he has advertised. But, because he knows he could run out of stock he cannot obligate himself in an OFFER of the goods that could be accepted by anyone any where unilaterally at any time where they could say they accepted the advertised offer and travelled 12 miles on the # 141 bus passed the west side of Stoke Newington or 12 stops on the overground train from Mhres-tham Nayr to buy those Costa Rican Bananas or Namibian Bananas at Morrisons. Maybe they travelled from Helptham Aye.

In some cases these days, the retailer will accept a lower price on a price match agreement if you bring evidence of a lower advertised price from another retailer for the intended item. As such, he says he is inviting you to make offers that he will consider and its usually that you will pay what is advertised in the store; maybe less money if you work hard to price match for lower prices for all items on our intended grocery list. You would not price match to pay a higher price or the same price but a lower price. It only takes a minute to get the advertised lower price from the newspapers or online if you are not a lazy rubbish bugger.

Write down your list and make an offer to the retailer as he invited you to make price match offers to him so that he can consider them in his invitation to treat/consider offers. So an invitation to treat is an offer to the public to consider offers.

The issue here is when the travelling shopper could show up and say that because he understood your advertising as an offer, they accepted it and travelled to confirm the agreement, you owe him at least one banana at that price from the country advertised and maybe those bananas will not be available again; sold out and he needs them to make special pancakes! So, then the retailer would be liable for what they call a loss of bargain and breach of contract and could be sued for damages by any potential consumer that could accept the offer but the retailer has run out of stock. So, then the retailer, instead, is inviting offers for the retailer's consideration from consumers at the price listed generally or under the price match plan.

The consumer comes to the shop, collects his selection of goods and will arrive with the items in hand at the cash register if they are available and then makes his offer to buy at a particular price. The retailer will then accept, take payment and provide the written receipt and agreement with terms and conditions for the store warranty and returns policy. This shop receipt is evidence of a contract.

The retailer turns on the cash register, takes the consumers card, swipes it and it says "Declined" because it is expired. So, the consumer takes another card out of his coat and tries again, swiping it and the cash register says "Approved." The receipt is provided. He also buys some Mentos, a bottle of "Milkis" with the few pound coins in his pocket and goes home to make Namibian banana pancakes.

. Examples may involve the car dealer also where they may say the price for the 2009 Ford Focus RS9 in Green is £10,000.00. That is an offer in the usual sense and it only takes one buyer to arrive and accept. But you can make an offer for a few 100 pounds less off the listed price and hope the seller will agree at £9,300.00 and he may say he will finally agree at £9,800.00 to accept this amount.

What if you wanted to order 12 Focus vehicles you hear are available for import from Germany to be shipped in containers with VAT tax included at £10,000.00 each. So, what is the purchase price for all 12 vehicles? You have to pay shipping and insurance at $1.00 USD per km per vehicle to be shipped from Bonn, Germany to Feltham. What is the cost of shipping in Euros and in pounds? The exchange rate to convert USD to Pounds is $1 USD = 80 pence. So, then you will take the USD amount and multiply by .80 to get the amount needed in pounds and multiply by .94 for Euros when $1 USD= 94 cents Euro. They had to buy wheel covers for all 12 vehicles. How many wheel covers do you need? Each wheel cover is $5.00 each. How much do you have to spend? There is a windshield cover with 4 angles in its rectangular, 4 sided polygonal shape. Each corner has an angle. Two angles are about 98 degrees each. What is the measurement of the other two angles when all 4 angles have to add up to 360 degrees?

You can use the dock at Greenwich as the final destination dock and you need to work out the distance from Bonn using google to answer the insurance question?

//////////////////////////////////. See the numerical answers by next Saturday.

Total purchase price: £120,000.00

Distance from Bonn to Greenwich is 596.2 km on average by car at least according to Google and we will use this figure for our calculation. This is about 273.2 Nautical miles. So the cost of insurance and insurance per vehicle is $596.20. The total insurance and shipping cost for all vehicles is $7154.40. It is £ 5723.52 pounds and $ 6725.14 Euros.

You need 48 wheel covers with 4 covers per vehicle and at $5.00 each, this will cost $240.00.

The top and larger angles on the windshield cover are 98 degrees. The smaller angles are 82 degrees each.

.

https://www.rmg.co.uk/sites/default/files/styles/full_width_1440/public/2021-10/2.jpg?itok=_K-OzX7f

Review the Chapelton v. Barry UDC case one more time. Then read Partridge v Crittenden [1968]. ClIck the link.

.....Generally, advertisements are not offers but invitations to treat, so the person advertising is not compelled to sell. In Partridge v Crittenden [1968] 1 WLR 1204, a defendant who was charged with "offering for sale protected birds"—bramblefinch cocks and hens that he had advertised for sale in a newspaper—was not offering to sell them. Lord Parker CJ said it did not make business sense for advertisements to be offers, as the person making the advertisement may find himself in a situation where he would be contractually obliged to sell more goods than he actually owned.

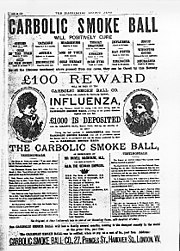

Lastly, lets consider the offer in this scenario where you read a promotion that says Camel and Marlboro Cigarettes from Germany; whole cartons 50% off regular price available to the first 500 customers who arrive and order them with stock behind the counter. This is considered a a unilateral offer since the offer is limited numerically to the first 500 people and presumedly the genuine retailer will entertain the first 500 people who come to accept the deal and then they will have run out of stock. This is an offer to the public that the public can accept in the limited quantity. See the Case Carlil v. Carbolic Smoke Ball for more. Click here

Carlill v Carbolic Smoke Ball Company [1892] EWCA Civ 1 is an English contract law decision by the Court of Appeal, which held an advertisement containing certain terms to get a reward constituted a binding unilateral offer that could be accepted by anyone who performed its terms. It is notable for its treatment of contract and of puffery in advertising, for its curious subject matter associated with medical quackery, and how the influential judges (particularly Lindley and Bowen) developed the law in inventive ways. Carlill is frequently discussed as an introductory contract case, and may often be the first legal case a law student studies in the law of contract.

The case concerned a flu remedy called the "carbolic smoke ball". The manufacturer advertised that buyers who found it did not work would be awarded £100, a considerable amount of money at the time. The company was found to have been bound by its advertisement, which was construed as an offer which the buyer, by using the smoke ball, accepted, creating a contract. The Court of Appeal held the essential elements of a contract were all present, including offer and acceptance, consideration and an intention to create legal relations, and rejected a number of defenses, including puffery.[2]

Facts

The Carbolic Smoke Ball Co. made a product called the "smoke ball" and claimed it to be a cure for influenza and a number of other diseases. (The 1889–1890 pandemic ongoing at the time was estimated to have killed 1 million people, but may have been caused either by influenza or a coronavirus.) The smoke ball was a rubber ball with a tube attached. It was filled with carbolic acid (or phenol). The tube would be inserted into a user's nose and the ball would be squeezed at the bottom to release the vapours.

The Company published advertisements in the Pall Mall Gazette and other newspapers on November 13, 1891, claiming that it would pay £100 (equivalent to £12,000 in 2021) to anyone who got sick with influenza after using its product according to the instructions provided with it:

Louisa Elizabeth Carlill saw the advertisement, bought one of the balls and used it three times daily for nearly two months until she contracted the flu on 17 January 1892. She claimed £100 from the Carbolic Smoke Ball Company. They ignored two letters from her husband, a solicitor. On a third request for her reward, they replied with an anonymous letter that if it is used properly the company had complete confidence in the smoke ball's efficacy, but "to protect themselves against all fraudulent claims", they would need her to come to their office to use the ball each day and be checked by the secretary. Carlill brought a claim to court. Counsel representing her argued that the advertisement and her reliance on it was a contract between the company and her, so the company ought to pay. The company argued it was not a serious contract.

Judgment

The Carbolic Smoke Ball Company, represented by H. H. Asquith, lost its argument at the Queen's Bench. It appealed straight away. The Court of Appeal unanimously rejected the company's arguments and held that there was a fully binding contract for £100 with Carlill. Among the reasons given by the three judges were (1) that the advertisement was not a unilateral invitation to treat to all the world but an offer restricted to those who acted upon the terms contained in the advertisement (2) that satisfying conditions for using the smoke ball constituted acceptance of the offer (3) that purchasing or merely using the smoke ball constituted good consideration, because it was a distinct detriment incurred at the behest of the company and, furthermore, more people buying smoke balls by relying on the advertisement was a clear benefit to Carbolic (4) that the company's claim that £1000 was deposited at the Alliance Bank showed the serious intention to be legally bound. The judgments of the court were as follows.[4]

Lord Justice Lindley

Lindley gave the first judgment on it, after running through the facts again. He makes short shrift of the insurance and wagering contract arguments that were dealt with in the Queen's Bench.

He follows on with essentially five points. First, the advertisement was not "mere puff" as had been alleged by the company, because the deposit of £1000 in the bank evidenced seriousness.[5] Second, the advertisement was an offer made specifically to anyone who performed the conditions in the advertisement rather than a statement "not made with anybody in particular." Third, communication of acceptance is not necessary for a contract when people's conduct manifests an intention to contract. Fourth, that the vagueness of the advertisement's terms was no insurmountable obstacle. And fifth, the nature of Carlill's consideration (what she gave in return for the offer) was good, because there is both an advantage in additional sales in reaction to the advertisement and a "distinct inconvenience" that people go to when using a smoke ball

Comments

Post a Comment